Blog

Learnings from 100+ Angel Investments

I’m sharing my experiences to help aspiring, beginner, and novice angel investors learn from my mistakes, and consequently, become better angel investors more quickly.

Things to consider before starting

You don’t need to know all of these things before you start. Heck, you don’t need to know any of them! However, considering these topics up front will make you a more effective investor, faster. I wish I had done so.

Identifying your “Why?”

Are you doing this to give back to entrepreneurs? To support causes you care about? For fun/entertainment? To stay active? To diversify your financial portfolio? To create wealth?

All these reasons are valid motivations for angel investing! The crucial aspect is not the answer itself, but your awareness of what your answer is, because that impacts many aspects of your strategy.

How much to invest

It’s helpful to set an overall target so you can decide how much to invest per company. You might decide this based on some percentage of your liquid net worth or some percentage of your annual income – both good options – or some other process. The focus here is less about the specific amount you choose (I suggest discussing this with your financial advisor) and more about setting a clear target.

The total amount you decide on becomes your bankroll. By dividing your bankroll by your target number of investments, you determine your unit size, which is the amount you’ll invest in each company. Being thoughtful about your unit size up front makes things easier for you over time.

Your investment thesis

Simply put, an investment thesis refers to the type of companies or Founders you wish to invest in. While having an investment thesis is completely optional – I started with almost no thesis whatsoever! – having some guideposts can make many aspects of angel investing easier, from sourcing to vetting to ongoing management of your portfolio.

Some things to consider that could be part of your investment thesis:

- Sectors/categories: SaaS, Consumer Tech, Medical Device, CPG, Food & Beverage, Climate Tech, Space Tech.

- Stage: pre-product (idea stage), post-product but pre-revenue, post-revenue but before product market fit, growth capital.

- Founder attributes: experience, affinity, demographics.

- Geography.

Basic math

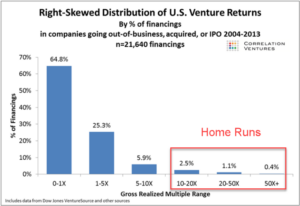

Startups are very risky investments. Most will fail and return no capital at all (70-90%). Most of the others will be small wins and will return 0x-5x of your capital (10-25%). A small fraction will be “home runs” and will return 10x or more (less than 5%). This is known as the “Power Law” in startup investing. It’s important to understand this so a) you aren’t dismayed when an investment fails, and b) you form an investment strategy accordingly (see “High volume strategy is best” below).

Performance expectations

In addition to being risky, startups are also highly illiquid investments. A successful startup will generally take 7-10 years (possibly longer!) to have an exit event and return capital to you. You will occasionally have earlier exits but those are generally smaller and unpredictable, and it’s best not to count on them.

If you invest a consistent dollar amount each year, it will likely take about 10 years before your startup investment portfolio becomes cash flow positive (i.e., produces more cash in a year than it consumes). Thus, a good investment strategy would be to only invest ~10% of your bankroll each year to account for this.

Startup investments should have a higher IRR (annualized rate of return) than other asset classes to make up for higher risk and longer time to liquidity. If bonds return ~3-6% per year, public stocks return ~8% per year, real estate returns ~10-12% per year, and private equity returns ~15% per year, then you should target at least 15% per year for your angel investment portfolio. Any less and you’re not getting commensurate upside for the risk you are taking.

My key learnings

High volume strategy is best

If your objective is to maximize the probability of having a positive financial return, then the single most important thing you can do is diversify your angel investments across a large portfolio. I believe this statement is more of an objective truth than merely an opinion.

Why? Recall the “Basic math” above: most investments fail, most of the rest generate some return, and the majority of return comes from a small minority of investments (i.e. the “power law”). To profit from angel investing, you need to have home runs in your portfolio, but the odds of each investment being a home run are low. Thus, the mathematical optimal strategy is to make lots of investments which a) increases the odds of having a home run in your portfolio, and b) decreases the odds that every company in your portfolio fails.

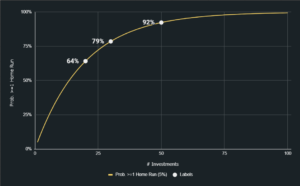

Here is a visualization of that math. Assuming each individual investment has a 5% chance of being a home run, then your odds of having >=1 home run in your portfolio are: 64% with 20 investments, 79% at 30 investments, and 92% at 50 investments. At minimum, your portfolio should be at least 20-30 investments.

Access matters most

Consider two hypothetical investors:

- Investor 1 has access to the best Founders/deals and invests in each one without any “picking”

- Investor 2 has no/minimal access to the best Founders/deals but is an incredible “picker” of companies

Which investor will have better returns? I contend it will be Investor 1 and it won’t even be close. Why? Because the best Founders/deals are substantially more likely to produce home run outcomes and that’s where most of your financial return comes from. To quantify this, I think Investor 1 could achieve venture-like returns whereas Investor 2 may not even be profitable.

I believe angels should prioritize building access to great Founders and deals over honing their ability to pick companies.

Shoot for big outcomes

Most angel investments fail and getting a positive outcome of any size is really hard. When a company defies these odds and has a positive outcome, I want the potential for that outcome to be really big. Thus, ‘How big can this company be?’ is an important investment criterion for me.

My framework is something like this: If everything goes right for this company, how big can it be? I want to see a minimum of 10x-20x return potential but most likely 50x or 100x in order to invest. The inverse of this is that I will pass on investing if the answer is 5x-10x even if I really like the Founder/company.

I’ll add a caveat here that this is at least in part personal preference and also closely linked with my portfolio size of 100+ investments. I know angel investors who prefer to invest in deals with 5x-10x potential that have a perceived lower failure rate & higher exit rate, and I believe this strategy has the potential to be profitable as well.

Seek out high quality advisors

Angel investing is complex, with many nuanced legal and tax aspects to consider. Rather than try to learn & know all these nuances yourself, I suggest working with advisors who have experience with these nuances that affect angel investors.

There are two specific things I’ll call out to pay attention to. First, if you invest in convertible notes or SAFEs (which is highly likely as an angel investor), pay close attention to the “conversion math” that dictates how much equity you get in the company when they raise their next priced round. This math is complicated and can also be somewhat subjective depending on the nature of all the outstanding convertibles the company has. I find this math to be incorrect around 1/3 of the time and I always have my legal advisor double check. Second, pay close attention to the various tax incentives associated with angel investing. Section 1244 and Section 1202 are important at the Federal level, and many states including MN have an Angel Tax Credit program. These incentives can significantly reduce your tax liability and why I recommend focusing on post-tax values when measuring performance.

Anecdote: I once invested in an early stage company via a Post-Money SAFE. The company had outstanding convertible notes at the time. The company performed well and a couple years later was raising a Series A. When I received the proposed pro-forma cap table from the company’s counsel, I noticed my Post-Money SAFE was being treated as a Pre-Money SAFE, which meant I was being diluted by all other outstanding convertibles. I pointed out the error and the company fixed it (to be clear, this was a simple mistake with no nefarious intent). The end result was that, with the correct conversion math, I received 30% more shares. If this company is a massive home run, just that 30% delta could pay for my entire portfolio.

My biggest mistakes

I’m pretty sure I’ve made every mistake possible as an angel investor! Here are the most common and/or costly ones.

Avoid non-standard terms

It’s best for angels to stick with standard investment terms and resist the urge to get cute. Non-standard terms can deter future investors, making fundraising more challenging or even impossible. If the company does raise additional funding, it’s almost certain the new investors will inherit the same non-standard terms you got (or better). This will generally leave you worse off than if you had just started with standard terms.

There are free templates available for Post-Money SAFEs and Series Seed equity financings. These templates can accommodate most financings without modification.

Anecdote: I once invested in a repeat Founder who felt strongly that the valuation should be 2-3x the typical market rate for their sector and level of traction. The compromise reached with investors was to add a non-standard liquidation preference of 2x instead of the standard 1x. This meant investors would get 2x their money before Founders got anything so an above-market valuation seemed reasonable. However, when the company raised additional funding, the new investors also demanded liquidation preference of 2x on top of early investors. Early investors ended up much worse off than if we had stuck with standard investment terms.

Follow-on strategy

When I started angel investing, I had no strategy for follow-on investments. Should I invest more capital in future fundraise rounds of my portfolio companies or instead allocate that capital to investments in new companies? There are arguments for both strategies – I’ll delve deeper into this topic in a future post.

Regardless of what you decide, there is value to having a viewpoint on this topic prior to having to make a decision. If you do plan to invest in follow-on rounds, it’s helpful to think about parameters in advance for when you will follow-on vs. when you will not. Waiting to think about this until a decision is needed for a specific company may result in bias and sub-optimal decision making.

Anecdote: I’ve always felt that participating in follow-on rounds will ultimately lead to better overall portfolio performance, so that is part of my strategy. However, my criteria have changed from participating in almost all follow-on fundraises to having very strict requirements that I define in advance based on research.

No LLCs

I’ve written previously about why almost every Tech company that raises money from investors should be a C Corp. It is for these reasons and more that I will no longer invest in LLCs.

First, LLCs are not eligible for QSBS tax treatment. This alone is a disqualifier for me.

Second, VC Funds will generally not invest in LLCs. My preferred angel investing strategy means the companies I invest in will almost certainly require additional funding. My reasoning is that if the company will eventually need to convert to a C Corp, then there’s no reason not to do it now. For me, Founders who value the optionality of remaining an LLC longer are sending a negative signal to early investors, and I listen to that signal by passing on the investment.

Third, there are many tax-related annoyances of investing in LLCs, including: a) waiting to receive tax forms from the company called a K-1 before you can file your taxes; b) the potential for you to end up with taxable income despite not receiving any cash distributions; and c) having to file tax returns in other states due to nexus rules. I’ve had all of these things impact me.

Anecdote: I used to carve out exceptions for LLCs that were raising money on convertible notes or SAFEs under the assumption the company would convert to a C Corp prior to conversion as part of the next round. However, I encountered an edge case where the company was acquired before this conversion took place. The structure of the deal required me to convert my note into LLC interests, which meant all of the negative mechanical issues above for a small return.

Summary

I hope you found this post valuable! If you have feedback or suggestions for future topics, please let me know!